Traverse Insights

Tariff Turmoil

April 4, 2025 | World Economy

On April 2, 2025, President Donald Trump addressed the nation from the White House Rose Garden to announce a series of sweeping new tariffs, declaring the day as "Liberation Day" and describing the move as "our declaration of economic independence." He proclaimed that these measures were necessary to address what he termed a national emergency caused by large and persistent U.S. trade deficits.

The president unveiled a two-tier tariff structure: a universal 10% tariff on all imported goods, effective April 5, 2025, and additional country-specific "reciprocal" tariffs targeting approximately 60 nations with which the U.S. has significant trade imbalances. These higher tariffs, set to commence on April 9, 2025, include a 34% tariff on Chinese imports (in addition to existing levies), 20% on European Union goods, and varying rates on other countries such as Vietnam, India, and Japan.

President Trump asserted that these tariffs would bolster domestic manufacturing, create American jobs, and generate substantial revenue to reduce taxes and pay down the national debt. He emphasized that the U.S. was offering a "kind" approach by imposing tariffs that are only half of what, according to administration calculations, could have been applied based on other nations' trade practices. He challenged trading partners to "terminate your own tariffs. Drop your barriers," suggesting that such actions would lead to the removal of U.S. tariffs in response.

The announcement has elicited strong reactions both domestically and internationally, with concerns about potential trade wars, inflation, and impacts on global economic stability. Countries affected by the tariffs, including China and members of the European Union, have expressed dismay and signaled possible retaliatory measures.

With tariffs back in the headlines, for many CFOs, they're hitting closer to home than ever before. With new trade policies taking shape, supply chains under stress, and costs climbing, financial leaders are scrambling to figure out what it all means for their businesses.

Tariff hikes aren’t just a line item. They impact your pricing, your margins, your sourcing decisions, and even how you plan for the next quarter. In this article, we’ll break down what tariffs actually are, how they’re affecting businesses in five major ways, and—most importantly—what you should be doing right now to stay ahead of the curve.

Tariffs 101 – What They Are and Why They Matter

Let’s start with the basics. A tariff is a tax placed on goods that are brought into a country. Some are charged as a flat fee per item, others are a percentage of the item’s value. Governments use them for different reasons: to protect local industries, to retaliate in trade disputes, or simply to raise money.

In real terms, tariffs make imported goods more expensive. Think electronics from China, steel from Europe, or parts used in cars and solar panels—when tariffs go up, so do costs. For companies in the middle market, even small increases can add up fast. It’s also worth noting: tariffs are just one tool in the trade toolbox. There are also quotas, export bans, and subsidies. But unlike those, tariffs hit fast and will be felt by organizations almost immediately. For CFOs, knowing where tariffs show up in your supply chain is the first step in managing the risk.

Five Ways Tariffs Are Hitting Middle Market Businesses

They’re Driving Up Your Costs

This one’s the most obvious—and the most painful. Tariffs function as an immediate tax on imports, which directly impacts your cost of goods sold (COGS). Whether you’re importing raw materials, semi-finished components, or finished goods, your landed cost goes up. And unless you have pre-negotiated protections in place, your suppliers are going to pass those increases down the chain.

For many middle-market firms operating on tight margins, even a 2–3% increase can blow up a quarterly forecast. Budget variances start to spike, gross margins shrink, and working capital becomes harder to manage. And if you have long-term contracts with locked-in pricing, you might find yourself absorbing the full brunt of these increases with no recourse.

What’s worse: these cost pressures rarely show up in isolation. Tariffs often hit alongside rising freight rates, currency volatility, and energy costs—creating a compounding effect. CFOs need to treat tariff-driven inflation as part of a broader structural cost challenge, not just a temporary blip.

They’re Scrambling Your Supply Chain

If your supply chain was optimized purely for cost and speed, tariffs just lit a fire under it. Many middle-market firms have leaned heavily on low-cost-country sourcing—China, Southeast Asia, Eastern Europe—often with single suppliers per category. Now, with sudden tariff impositions, the economics of that model are changing overnight.

Tariffs are forcing companies to rethink their entire sourcing and logistics strategy. Dual sourcing, nearshoring, reshoring, and inventory pre-loading are all now on the table. These shifts come with added cost, complexity, and execution risk—but they’re fast becoming necessary.

For example, shifting from China to Mexico under USMCA may reduce tariff risk but increases lead times, border crossing complexity, and sometimes unit costs. Likewise, reshoring could avoid tariff exposure but require new capital investment, labor sourcing, and compliance obligations. CFOs must be embedded in these decisions—not just to assess cost impact, but to stress-test timelines, cash flow implications, and longer-term flexibility.

They’re Forcing Tough Pricing Decisions

Do you absorb the cost? Pass it on to customers? Somewhere in between? Pricing decisions are getting harder, especially if your competitors aren’t facing the same cost increases. For B2B companies with long-term contracts, it can be tricky to renegotiate terms. For B2C brands, raising prices risks alienating customers. Either way, CFOs need to be deeply involved in the pricing conversation.

They’re Shaping Your Investment Plans

Tariffs aren’t just short-term headaches. They’re influencing big-picture strategy too. Some companies are speeding up plans to automate. Others are thinking about investing in domestic production. But capital doesn’t move easily, and the ROI has to make sense. Tariffs are making strategic planning more complex—and more urgent.

They’re Creating Compliance Landmines

New tariffs mean new paperwork. Every product you import needs the right classification, documentation, and audit trail. Get it wrong, and you could face fines, delays, or even legal trouble. If your company doesn’t already have tight customs and compliance processes, now’s the time to tighten them up.

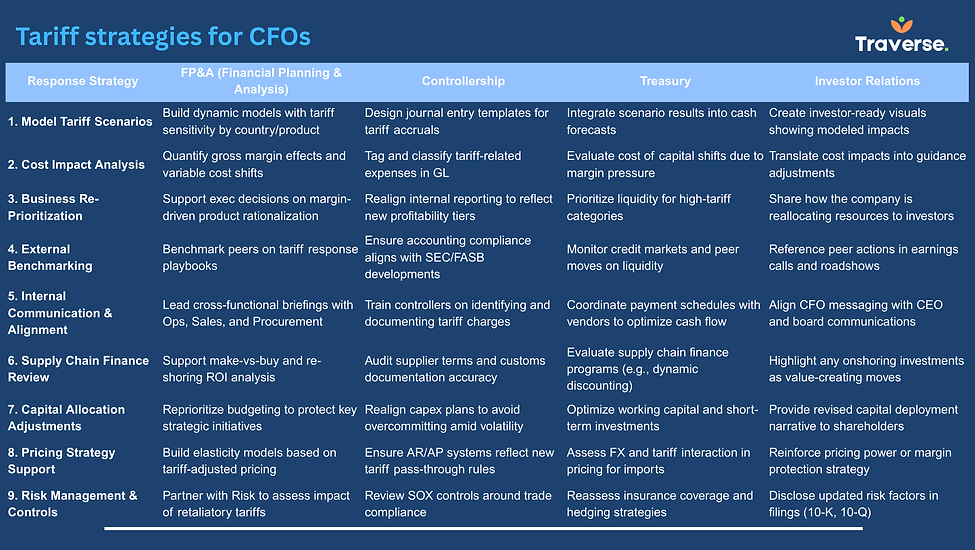

The CFO Playbook – What You Should Be Doing Now

Start With a Tariff Exposure Audit

You can’t manage what you don’t see—and with tariffs, the complexity runs deep. Begin with a thorough, cross-functional audit that identifies your direct exposure: which products you import, where they come from, and which Harmonized Tariff Schedule (HTS) codes apply. Go beyond your Tier 1 vendors—dig into your supplier’s suppliers, especially for critical components that may be sourced from high-tariff regions.

Pull customs documentation, invoices, and supply agreements. Identify which cost increases are locked in, which can be negotiated, and which might be avoided altogether through reclassification or alternative sourcing. Assign ownership: finance should lead the modeling, procurement should map supplier dependencies, and operations should assess the feasibility of changes.

Get your procurement, finance, and ops teams in a room—not in silos—to develop a unified view of the risk landscape. Create a live dashboard that tracks tariff exposure and updates with regulatory developments. This becomes the foundation for every scenario and strategic plan that follows.

Model Different Scenarios

Don’t wait for new tariffs to be finalized—model the “what ifs” now. What happens if tariffs on specific goods go up another 10%, or if a trade partner is suddenly subject to broad-based duties? What’s the cost impact if exclusions expire or enforcement tightens? Build dynamic models that incorporate various tariff regimes, timing assumptions, and geographic considerations.

Include FX volatility and commodity prices, especially for inputs like steel, aluminum, or semiconductors. Layer in operational impacts like shipping delays or inventory carry costs. These models shouldn’t just live in the FP&A team’s spreadsheet—they should be core to board-level discussions and annual planning. Use them to drive investment priorities, pricing strategies, and contingency playbooks.

Revisit Cost Structures

ariffs often reveal inefficiencies that have been hiding in plain sight. Now is the time to pressure test every cost input. Review your bills of materials (BOMs), supplier terms, packaging standards, and shipping methods. Can you source an alternative part domestically or from a lower-tariff region? Would redesigning a product to bypass a specific classification code deliver savings over time?

Consider forming a cost containment or value engineering task force. These groups should include finance, engineering, operations, and procurement—and they should be incentivized to find real, sustainable savings. Even modest reductions can help buffer against future tariff hikes.

Build a More Flexible Supply Chain

One supplier in one country is no longer a strategy—it’s a vulnerability. Begin developing a more agile supply chain by identifying second sources for critical inputs. Nearshore options—Mexico, Canada, or Central America—may carry slightly higher per-unit costs, but offer massive strategic value in responsiveness and tariff protection.

Map geographic risk exposure across all categories, then layer in lead times, quality considerations, and total landed cost. Consider “China +1” strategies or partnerships with third-party logistics providers that can help pivot sourcing faster. The goal isn’t perfection—it’s optionality.

Yes, building resilience can be expensive. But ask yourself: if tariffs spike again in six months, will you wish you had already started?

Work With Sales on Smart Pricing

Get in front of customers early. Explain what’s happening and why prices might need to change. Consider tiered pricing models or temporary surcharges with expiration dates. Make sure your messaging is clear: this isn’t about gouging—it’s about staying viable.

Where to Focus Right Now